Find out where you can get a Taste of TAB... our global events blast is on!

TAB Worldwide

TAB Argentina

TAB Australia

TAB Austria

TAB Canada

![Chile Chile]() TAB Chile

TAB ChileTAB Czech Republic

TAB England

TAB France

TAB Germany

TAB India

TAB Ireland

TAB Israel

TAB Lichtenstein

TAB Mexico

TAB Moldova

![Netherlands Netherlands]() TAB Netherlands

TAB NetherlandsTAB New Zealand

TAB Paraguay

TAB Portugal

TAB Romania

TAB Scotland

TAB Slovakia

TAB South Africa

TAB Spain

TAB Switzerland

TAB United States

TAB Wales

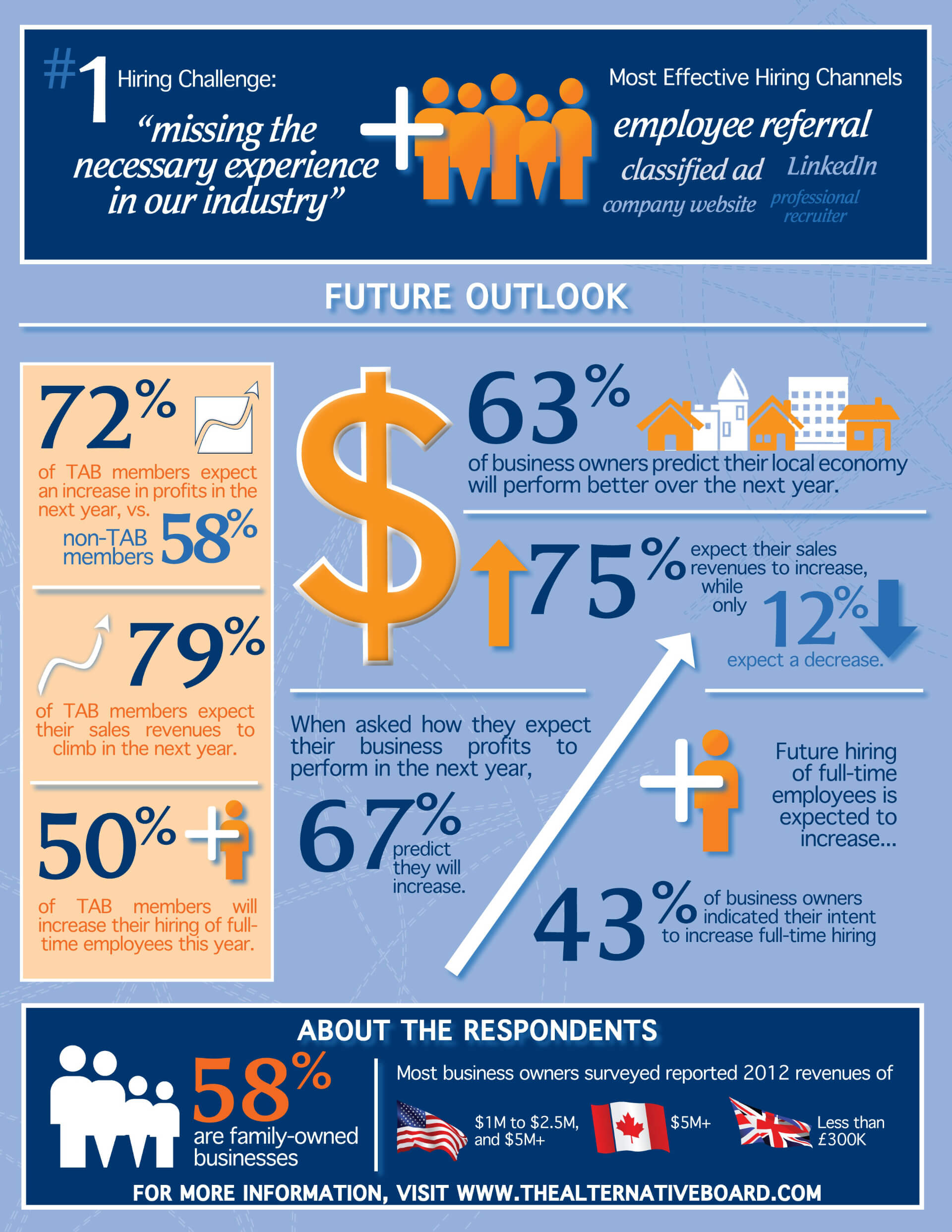

.jpg?width=2550&name=Business-Pulse-Survey-Hiring-Retention-2%20(1).jpg)